Endowment Management

Endowments offer donors the opportunity to create lasting legacies that will benefit future UNI students. Foundation staff will be pleased to work with you and representatives of the UNI program of your choice to help you establish an endowed fund at the UNI Foundation. Contact us at unif.financial.services@uni.edu.

Investment Success

We believe investment success is the result of:

- Preservation of capital with a focus on long term growth to build perpetual resources for the benefit of UNI's students, faculty, staff and programs.

- Strategic asset allocation guided by long term capital market expectations with an active approach to seek tactical opportunities.

- Risk management and diversification across asset classes, styles and strategies to align with our risk tolerances and return objectives.

- Disciplined manager selection and due diligence to engage high quality managers with demonstrated excellence and a repeatable investment process.

The UNI Foundation is proud to work with Graystone Consulting, our outsourced chief investment officer. Graystone offers the unique combination of an institutional consulting boutique with the global resources of one of the world’s preeminent financial organizations. A separate and independent business unit of Morgan Stanley, Graystone Consulting has approximately $610+ billion of institutional advisory assets and 45+ years of experience advising clients as a fiduciary (as of December 31, 2023.) Our Graystone Consulting team of professionals created a custom investment portfolio designed to meet our organizational and financial goals, and the Graystone solution allows us to focus on fulfilling our university's mission.

View our investment and asset allocation policies, as approved by the UNI Foundation board.

Fiscal Year 2026 Through August

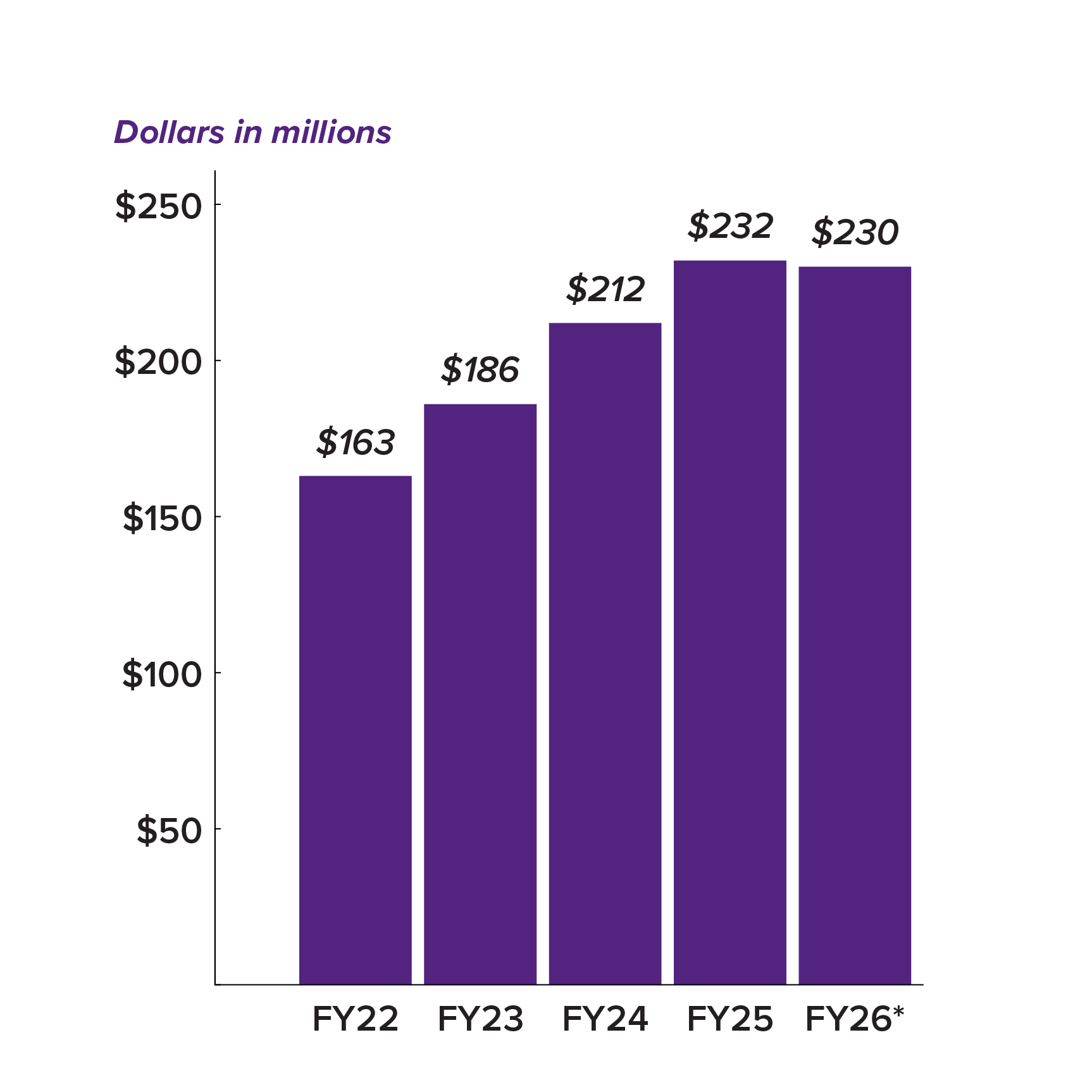

Total Endowment

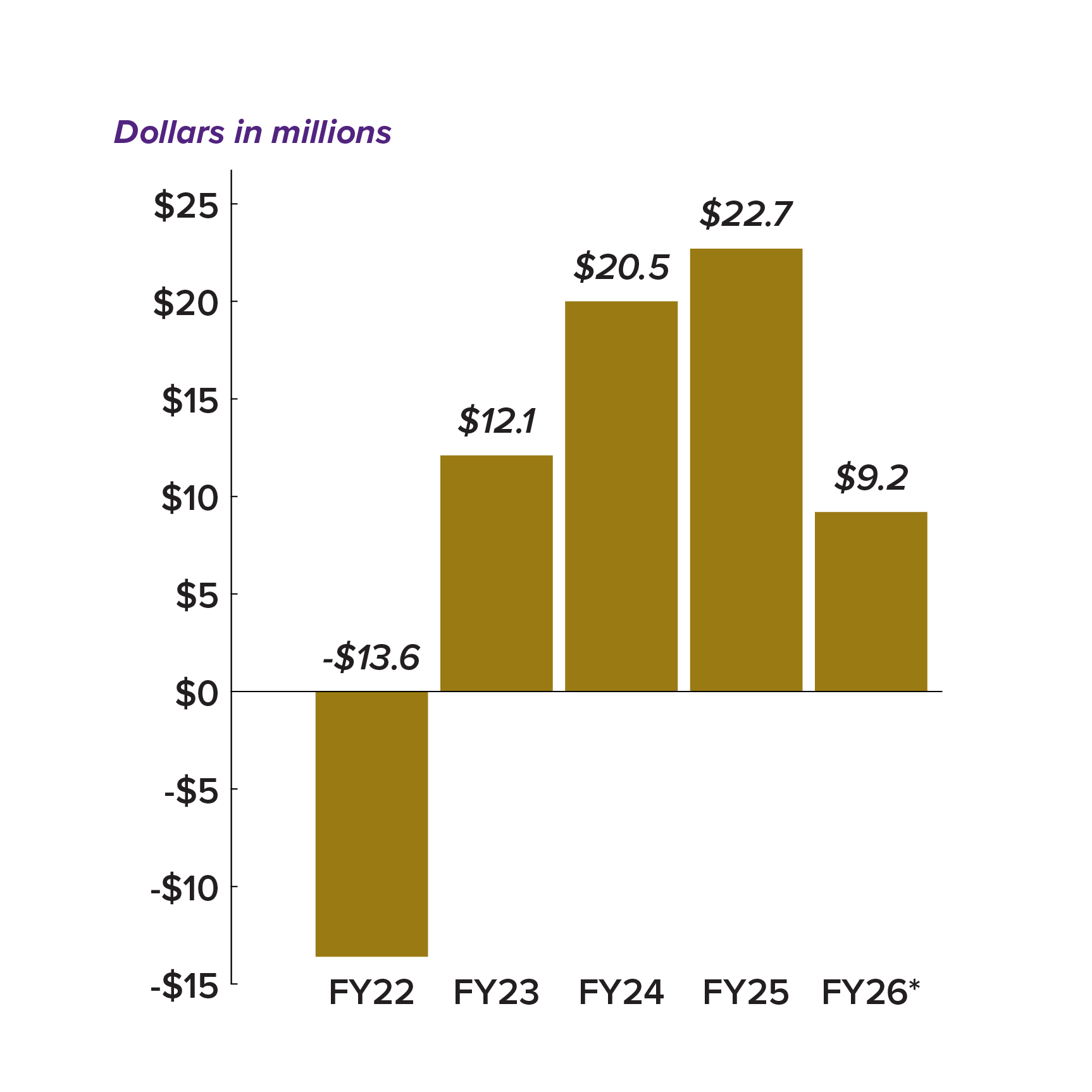

Endowment Market Earnings

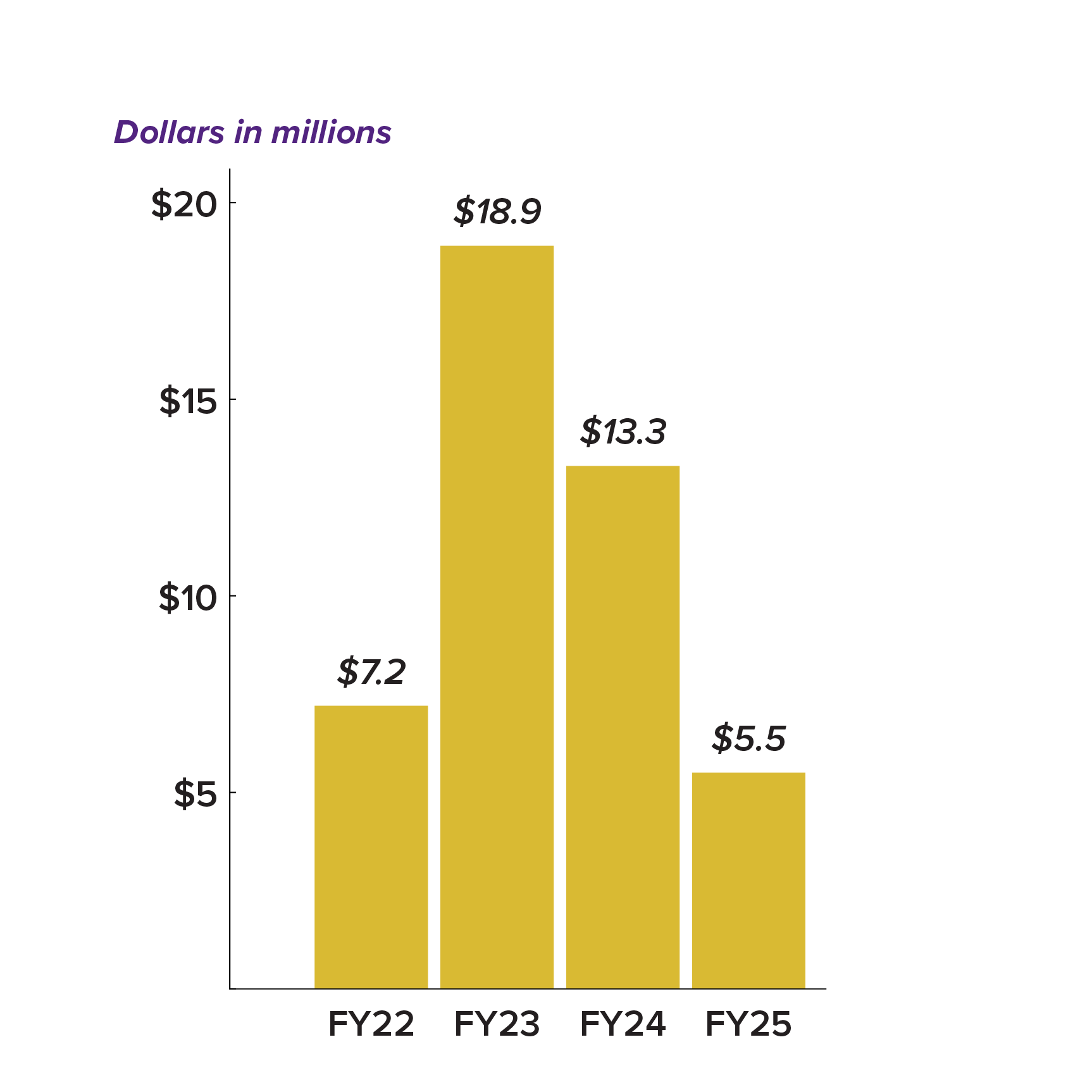

Contributions to Endowment

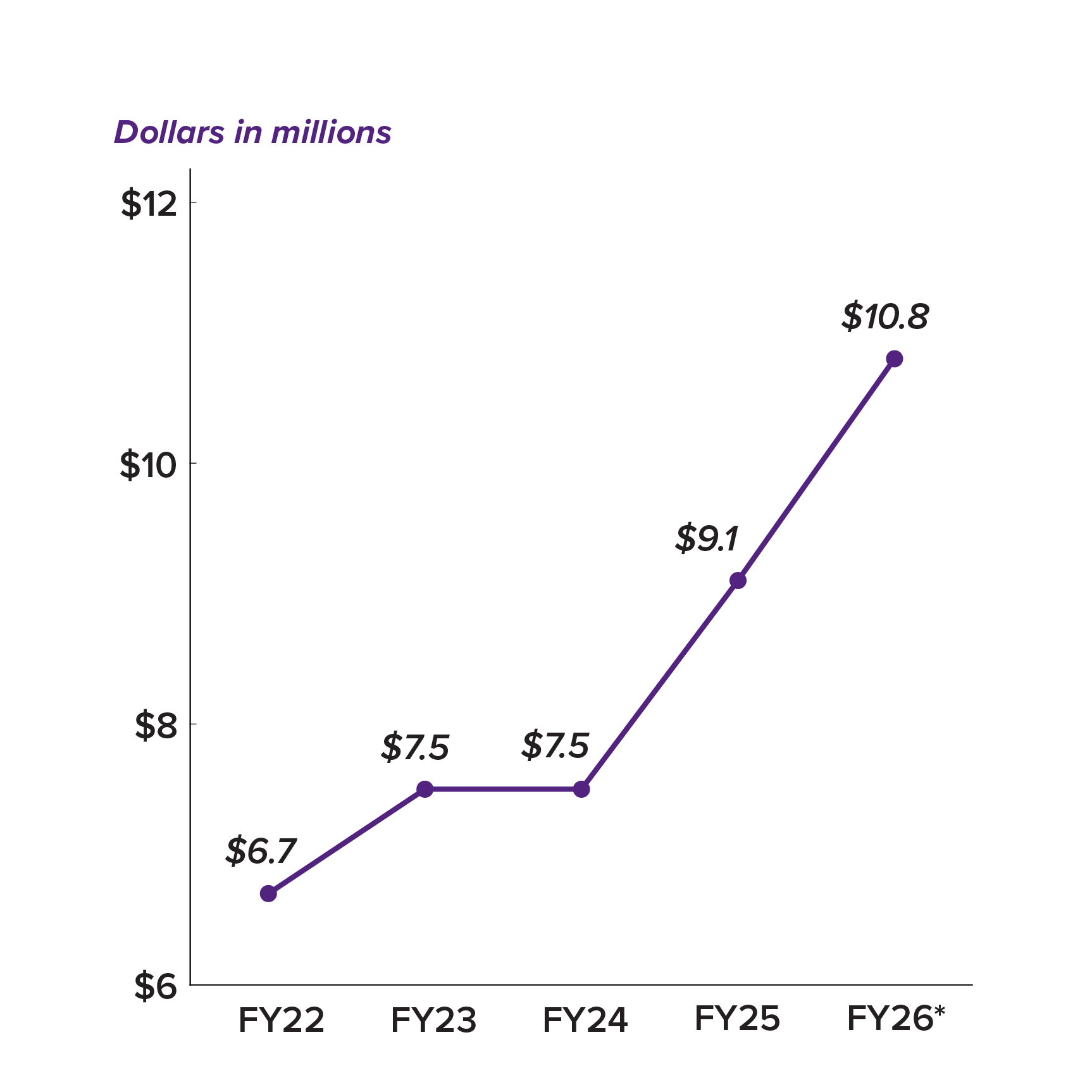

Distributions from Endowment

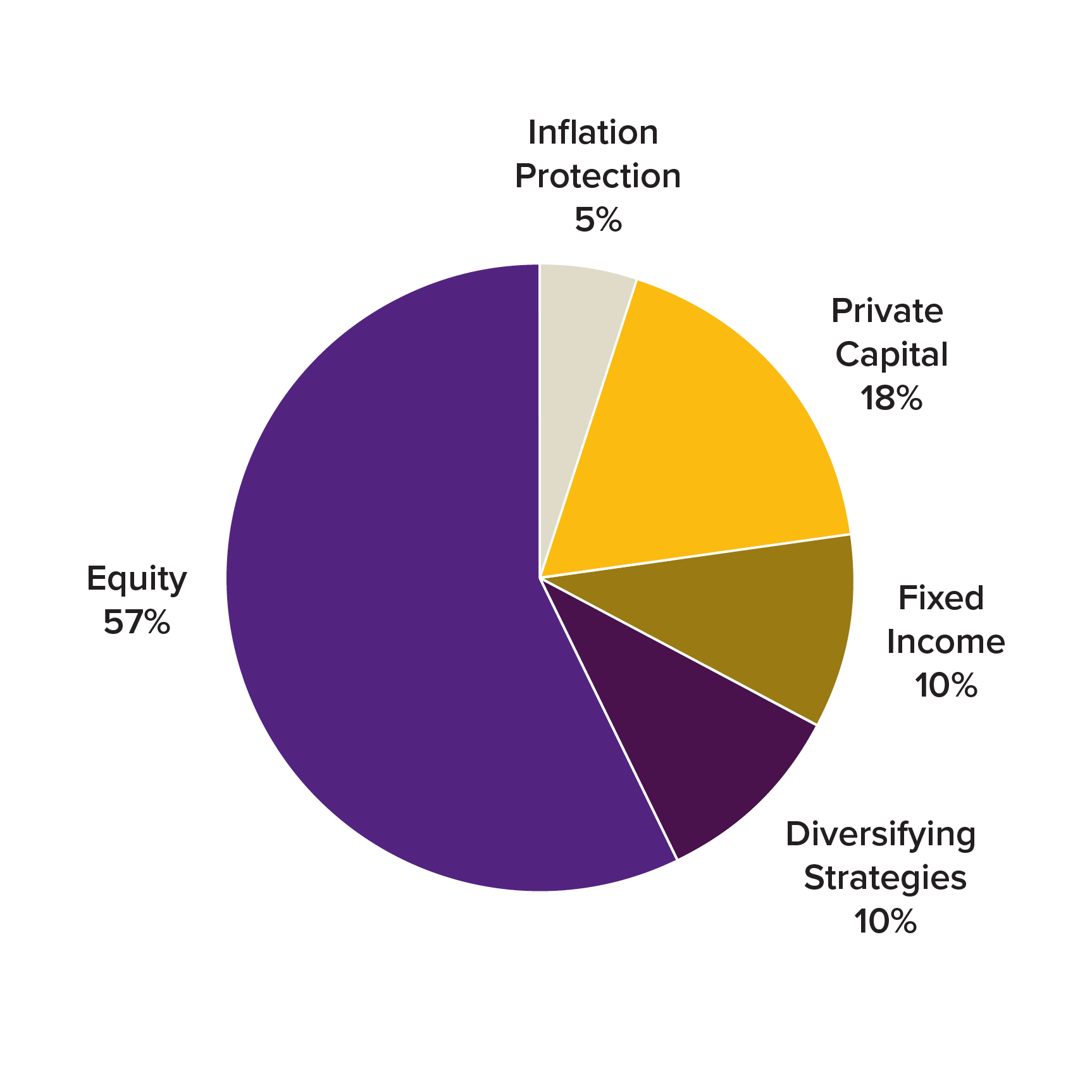

Endowment Asset Allocation

*Fiscal Year 2026 through August. Does not include cash balance of $1,177,880.

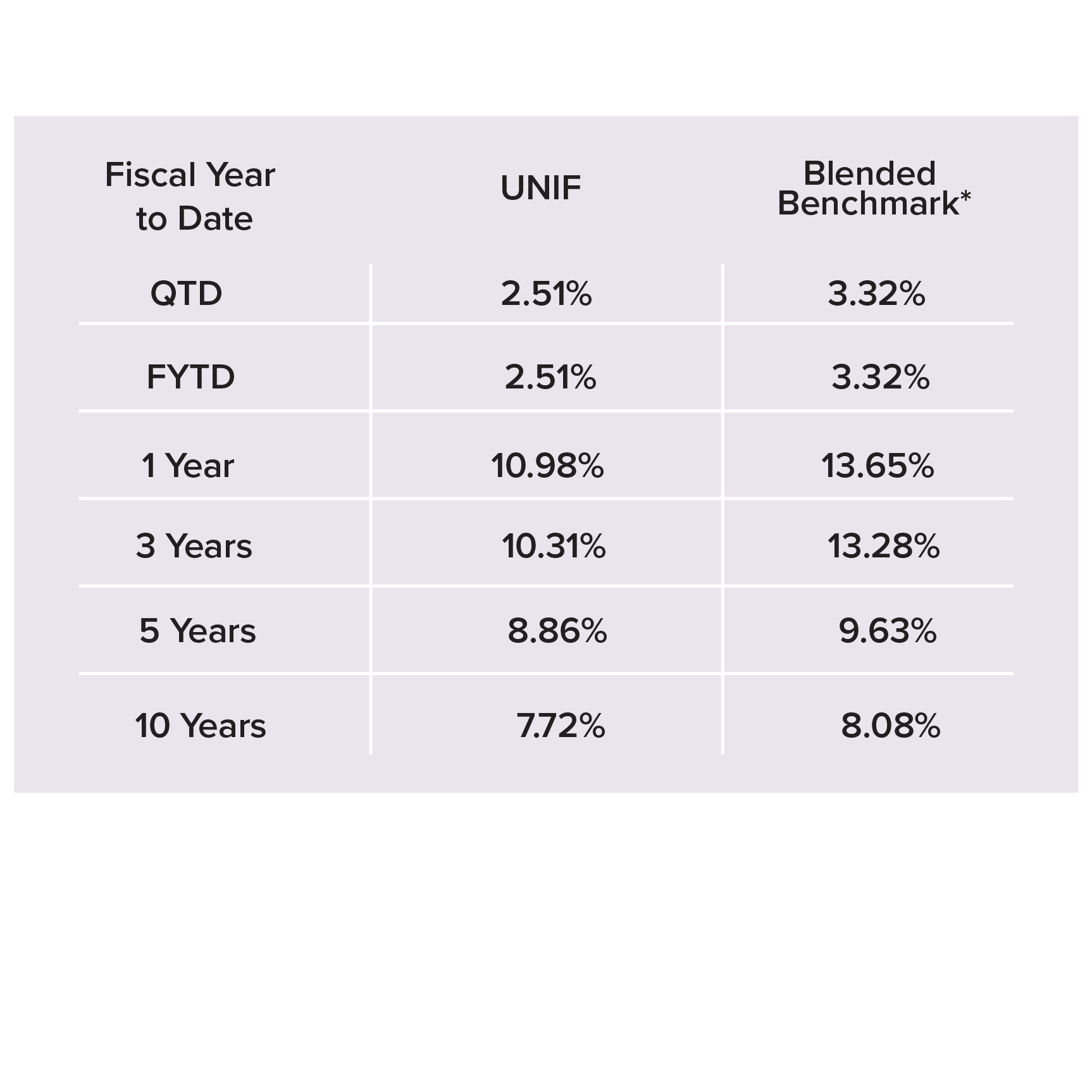

**IPS Blended Benchmark: Mirrors IPS Strategic Targets. Adapts over time and is currently 75% MSCI ACWI Net / 10% HFRI FoF/ 5% Bloomberg Commodities / 10% BC Agg (from 9-1-24 – Present).

***IPS Blended Benchmark ex-PC mirrors IPS strategic targets if private capital were removed from the portfolio.

Endowment Performance*

View the endowment summaries in PDF form for previous and current fiscal years.

Frequently Asked Questions

- What are the tax benefits of funding an endowment?

Gifts to the UNI Foundation are tax-deductible to the extent allowable by law. Consult your tax adviser to optimize potential tax benefits.

- What are other benefits to funding an endowment?

Endowments make it possible to provide funding in perpetuity to the university in areas you are passionate about. Despite declines in state appropriations, the university can continue to engage students in high-quality and high-impact learning experiences due to this ongoing funding.

- Do I need to fund my endowment all at once?

No. You may establish your endowment by making scheduled payments over a period up to five years; however, the sooner your endowment is fully funded the sooner an impact can be made. The minimum required to establish a named endowment fund is $50,000.

- Can I choose what I want my endowment to support?

Yes. You may designate a purpose, including priority needs of the university. Endowments generally fund scholarships, faculty positions and academic programs.

- How soon will my gift make an impact?

Every fully funded new endowment must be invested for one full fiscal year prior to being eligible for a payout. The amount available to spend is calculated by taking the average market value of the portfolio’s previous 12 quarters and multiplying this average times the spending rate. The UNI Foundation Trustees determine the spending rate each year, which is based off of UNI Foundation’s spending policy range of 4 to 6%.

- How can I make an impact now?

While your endowment is investing, you can make an additional impact gift to serve as the payout. Make a gift online now!

- Who is responsible for managing our investments?

Graystone Consulting has provided investment consulting services for the UNI Foundation endowment since January 1998. Among the reasons Graystone Consulting was selected was the firm’s extensive resources and expertise and ability to assist us in meeting our investment goals and mission objectives. For more information on Graystone Consulting, visit Graystone Consulting's website.

- How will I know my endowment is making an impact at UNI?

The UNI Foundation manages over 950 endowed donor-established funds, benefiting 60 university departments. These funds result in an average annual impact to the university of approximately $6.5 million. We provide an annual report that illustrates your endowment’s activity. For scholarship endowments, you will also receive information about your scholarship recipient.

- What are the fees associated with endowed funds?

The UNI Foundation charges a one-time 5% gift fee on all endowed gifts and pledge payments. This fee is based on a sliding scale as shown below:

- 5% on the first $500,000.

- 2.5% on the following $500,001 to $1,000,000.

- 1% on the following $1,000,001 and more.

- All realized expectancies, life insurance and life income gifts going to an endowment are charged a one-time 5% fee (not on a sliding scale).

In addition to the one-time gift fee is an annual fee, which is part of the spending rate calculation described above. On average, 1.65% of the spending rate goes towards UNI Foundation operations to cover ongoing administrative costs in managing endowed funds.

Life Income Gift Management

Midwest Trust Company, an independent, state-chartered trust company, and FCI Advisors (FCI), a premier Registered Investment Advisory firm, work together to provide administrative and investment services for the University of Northern Iowa Foundation Life Income Trusts. Midwest Trust was founded in 1993 and FCI was founded in 1966. Both firms have multiple offices across the country, with headquarters in Overland Park, Kansas and are owned by a common holding corporation. FCI Advisors adds value through tactical asset allocation and disciplined manager/mutual fund selection. They utilize low cost, institutional share class mutual funds as well as ETFs to build customized, well-diversified portfolios. FCI provides monthly detailed performance reports to assist the UNI Foundation in tracking their portfolios.

Contact Jane Halverson, our planned giving advisor, to learn more about life income gifts.